Buying a house is no small feat, but while it does require a lot of careful thought and assessment, the process involved doesn’t need to be complicated. We’ve done our best to simply describe the steps you need to take below, along with some of the most important points to keep in mind while completing each.

How much are you willing to spend?

First things first, it’s important to establish exactly what budget you are able to expend on the purchase of your potential new home. There’s no sense in looking for the perfect home, only to find that your favourite pick is way out of your price range.

The best option here is to consult an outside source; there are many budget calculators available online, though a financial advisor may be the better option; should you require a more in depth discussion, or be in a particularly complex financial situation. Waste no time and make an appointment today!

Picking the right mortgage

It’s a rare thing to be able to purchase a property without a mortgage being required; congratulations if you’re able to get the money together without, but for everyone else, here’s a breakdown of the more salient points.

- Make sure you have a secured mortgage offer before you begin searching for property; as with calculating your budget, you don’t want to locate the perfect house, only to find that you can’t actually secure a mortgage large enough to afford it!

- Generally speaking, to get the best mortgage rates you’ll want to be putting forward 15% of the property’s value or more. Contributing any less up front may result in additional cost incurred, or increased interest rates!

- Decide on a mortgage lender; it may be worth sticking with banks or building societies which you already have a relationship with, but if you’re not convinced by their offerings, then you may find a superior selection by consulting your estate agent, or a dedicated mortgage advisor.

- Ensure you have measures in place to deal with unexpected future events; you may be ok paying a mortgage right now, but will you be as comfortable doing the same if interest rates rise, or you lose your job? Make sure that you plan ahead, and leave some breathing room between what you can afford, and what you spend.

- Weigh up all of the potential mortgages you have seen, and decide on the best option for you. You may want to minimise your debt by choosing a mortgage shorter than the normal 25 year span, for example.

- The final step in securing a usable mortgage, is to request a mortgage in principle; essentially a representation of a mortgage lender’s willingness to provide a mortgage for you. With this, the seller of a property can be sure that you can put your money where your mouth is, making them more likely to accept your offer. Details of your mortgage in principle will be provided on request by the issuing mortgage lender, in the form of a ‘key facts illustration’, which provides interested parties with all of the key information in regards to the mortgage itself.

Locate the perfect property for you

When it comes to locating the perfect property for your needs, the best judge of each potential choice’s attributes will be you. Make a list of all of the features that you feel are important for your future property (such as a conservatory, or a garage); while it may be unrealistic to expect to find every one of the features that you desire in any one property, you should be aiming for a property that ticks most of the boxes.

Of course, the area surrounding the property should be matched to your personal taste as well; you’re not just buying into that building, you’re buying into the surroundings, and if they don’t match what you want; like having a nearby school for the easy access of your children, then you’re better off looking elsewhere, even if the house is otherwise perfect!

Helping you find the perfect property

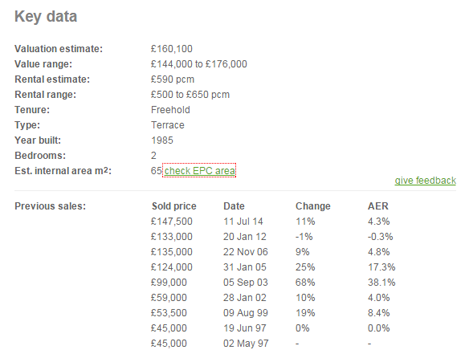

Finding out what the property has previously sold for can help you identify what you can can afford based on mortgage availability. Mouseprice provide historic house prices allowing you to see whether the area has seen growth too, knowing the difference in price between two local areas can significantly increase the ability to get the home of your dreams!

Mouseprice Pro also provides additional search data such as the Comps Search (comparable property), this allows you to find a property with your requirements that are nearby if your preferred area is outside of your acquired mortgage range.

Viewing essentials

The key with viewings when you’re looking to buy a house is to be prepared; make a list of questions to ask, and things to look for when you’re viewing the house, so you can be sure as to if the property is worth further attention or not. Most estate agents and other sellers won’t have an issue with you taking photos of the property, or measuring up rooms, so make sure you also take a tape measure and a camera (or just take pictures with your phone!). Remember to ask though; it’s not an unreasonable request, but you may not always get a reasonable response!

For further tips on what to expect from, and how to prepare for, a property viewing, take a look at the advice that we provide for those hosting a viewing. Seeing the process from the sellers perspective can help to give you the edge that you need!

Get the best offer possible

Negotiation is the key to getting the best price for your property; but a successful negotiation requires research, and a degree of risk taking. By establishing how long the property you wish to buy has been on the market already, you can establish how desperate the current owners are to sell; if they’re part of a chain, for example, they may be very eager to sell before the property that they want to move into becomes unavailable. If the local area is rife with property for sale, this can also be used to your advantage, allowing you to drive their price down with the threat of local competition.

Using the reports and data available on Mouseprice allows you to identify estimates based on previous sales and neighboring properties. By signing up for a free account you are able to receive free 'property worth' estimates and Automated Valuation Model (AVM) reports.

Mouseprice Pro - Individual property search

Mouseprice Pro allows for even more property data to help you make smarter decisions and negotiate the perfect price.

Gazumping

If you’re feeling brave, you can also try to gazunder the seller. That is, lowering your offer just before you sign contracts, to see if the buyer’s desire to sell will undermine their resistance to a lower price. You might get lucky, or you might just make them angry; so be careful!

One thing to bear in mind once a price has been agreed; if the property is not taken off the market, you still run the risk of being gazumped! Similar to being gazundered, gazumping involves another buyer jumping in with a higher price just before you make the sale, pricing you out, and losing you the property. All you can do to avoid this taking place is ask the sellers to remove the property from the market once a price has been agreed, and hope that they say yes!

Finally, it’s important to make it clear that your offer is tied into the property that they are selling being all that they say it is; if your surveyor comes back after you’ve made the purchase and tells you that thousands of pounds worth of repairs need to be made, it’s already too late!

Getting your head around conveyancing

The final process in buying a house is conveyancing; the transferring of the legal ownership of the property from the hands of the current owner, to you. This process generally necessitates the involvement of a conveyancer; a lawyer specialising in the smooth completion of this process.

As a result, the conveyancing process for most people comes down to getting the best conveyancer for the job at the best price; once this has been done, the process is relatively passive for the buyer themselves. In order to get the best price for conveyancing, ensure that you compare the prices of multiple conveyancers, ensure that they’ll be able to get their work done in the timescale you have in mind, and aim for a no win- no fee type arrangement; you don’t want to be paying for an incomplete job!

Once the conveyancer has done their job, you should be all set to move in!